|

|

|

in Focus

|

|

|

|

|

|

|

|

|

|

|

MoF

|

|

|

Meetings on GST, Corporate Tax and

Transfer Pricing issues

|

|

We, along with the industry, held

detailed discussions with the senior

officials of Ministry of Finance on

April 26 and 27 on key measures to

improve ease of doing business under GST

and corporate tax and also increase the

global competitiveness of India’s

transfer pricing regime.

|

|

|

GST:

|

|

|

|

|

Review of the concept of

intermediary services

under the GST which

results in levy of GST

on exports and

challenges in cross

border HO-BO operations.

|

|

Concerns with respect to

levy of GST on

share-based payment to

employees, free of cost

supply of intangibles,

etc.

|

|

Need for rationalising

the rate of TCS to ease

working capital for

sellers on ecommerce,

enabling the concept of

virtual place of

business for sellers

tagged to the locations

of the warehouses of the

e-commerce operator,

where the goods are

stored.

|

|

|

|

|

|

Corporate Tax:

|

|

|

|

|

Resolution of

operational issues

related to faceless

assessment and delay in

disposal of appeals at

higher levels.

|

|

Addressing challenges of

compliance with Angel

Tax provisions for the

start-ups as well as the

need to further ease the

taxation of ESOPS.

|

|

EoDB issues for the

MSMEs.

|

|

|

|

|

|

Transfer Pricing:

|

|

|

|

|

Expanding the scope of

the safe harbour regime

by removing the

threshold of Rs 200

crore of annual cross

border trade and

reducing the prescribed

profit margins to bring

them in line with global

trends.

|

|

Reducing the time taken

to conclude the APAs.

|

|

|

|

|

|

These topics, along with several others,

formed the core agenda of the

discussion, reflecting the pressing need

for streamlined tax policies and

resolutions to long-standing

complexities in the taxation landscape.

The suggestions were well received by

the ministry and we will be following up

with them for suitable next steps.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIALOGUE & DISCUSSION

|

|

|

|

|

|

|

|

|

|

|

MOLE

|

|

|

Meeting with Secretary

|

|

|

|

|

Nasscom, along with the industry, had an

interaction with the Secretary, MOLE and

her team on April 25, 2024. We discussed

various EoDB issues for the IT-BPM

sector and plan to work closely with

MOLE on the implementation of the Labour

Codes. We also presented a copy of the

Handbook on Labour Codes

to the Secretary, MOLE. The Handbook has

been made in collaboration with our

knowledge partner, Nishith Desai

Associates, to serve as a ready

reference guide for CXOs and public

policy professionals highlighting key

changes in the Labour Codes, with a

particular focus on the IT-BPM sector.

|

|

|

|

|

|

|

|

|

|

|

Industry

|

|

|

Complying with the DPDP Act: Examining

Industry Perspectives

|

|

|

|

|

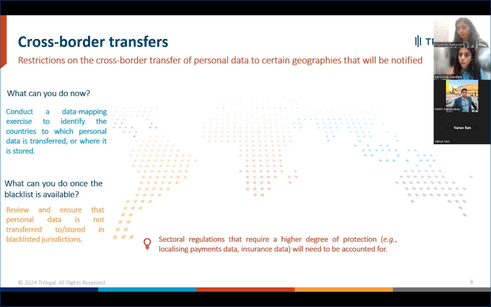

We hosted a webinar on "Complying with

the Digital Personal Data Protection

Act: Examining Industry Perspectives" on

April 25, 2024. We were joined by legal

experts from Trilegal. The webinar

provided a practical guide and primary

steps to initiate compliance with the

DPDPA. The discussion provided insights

on specific data processor obligations,

navigating the employment exemption

under the Act, and application of the

Act on the GCC industry, among others.

|

|

|

|

|

|

|

|

|

Karnataka Govt

|

|

|

Meeting with Karnataka IT Department

on GCC policy

|

|

We met officials of Karnataka IT

department to discuss the state GCC

policy along with representatives

from the Industry. During the

discussion, we gave an overview of

how the GCCs are growing in India

and suggestions on policy

imperatives required for their

future growth. These included

infrastructure and skill

development, fiscal incentives, etc.

|

|

|

|

|

|

|

|

|

Industry

|

|

|

New Member Connect

|

|

|

|

|

|

Nasscom membership team organised

the new member orientation and

networking meet on April 30, 2024.

Over 50 new members explored

initiatives in Policy, GTD,

Insights, DeepTech, and

Apprenticeships, learning about

diverse engagement opportunities.

From the policy team, Ashish

Aggarwal presented the working of

the policy team, key areas of focus,

impacts created and engagement

initiatives.

|

|

|

|

|

|

|

|

|

Industry

|

|

|

Roundtable on Space Tech

|

|

|

|

|

On April 20, 2024, we, along with

nasscom Deep Tech start-up team, in

partnership with ISpA, organised a

closed-door roundtable to gather

insight into the challenges faced by

start-ups in SpaceTech ecosystem.

The roundtable saw participation of

diverse representatives from

industry, legal fraternity,

academia, and INSPAC-e. Start-ups

highlighted several policy issues in

the space sector, such as, the lack

of adequate standards for the

sector, difficulties in obtaining

access to testing infrastructure,

and the long-time taken in

completing procurement process.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEW & UPCOMING

|

|

|

|

|

|

|

|

|

|

|

RBI

|

|

|

Draft Directions for regulation of

PA

|

|

RBI has published two draft

directions on regulation of PAs:

(1) Draft Directions for

regulation of PA - Physical Point

of Sale, and (2) Draft amendments

to existing directions on PA

related to due diligence of

merchants, operations in escrow

accounts, agents of PAs etc. To

send your inputs on these, please

write to

policy@nasscom.in

by May 8, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

RBI

|

|

|

Draft Guidelines on Digital

Lending - Transparency in

Aggregation of Loan Products from

Multiple Lenders

|

|

RBI has published draft Guidelines

to enable transparency in

aggregation of loan products from

multiple lenders. The Guidelines

mandate compliance with a view to

enable borrowers to have prior

information about the potential

lenders to be able to make an

informed decision. To send your

inputs on these, please write to

policy@nasscom.in

by May 10, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER UPDATES

|

|

|

|

|

|

|

|

|

|

|

RBI

|

|

|

Evaluating Linguistic

Complexity of RBI's

Regulations

|

|

Published in RBI's April 2024

Bulletin, this article gauges

trends in complexity of

language used in domestic

banking sector regulations

issued by Department of

Regulation, RBI, from 2017 to

2022. The analysis suggests

that regulations require a

graduate or post-graduate

degree for understanding,

which is generally the

education level of commercial

bank employees. The article

concludes that going ahead,

with more disruptions and

innovation, regulation may

become more complex and tools

to address complexity may

become easily accessible to

the regulators.

|

|

|

|

|

|

|

|

|

|

|

|

|

State Governments

|

|

|

Exemption from full-day mandatory closure of operations for general election

|

|

Government of Telangana and Government of Andhra Pradesh have notified an exemption for the IT/ITeS industry from mandatorily closing operations for full-day for exercising franchise for the general elections, owing to its continuous operations. It was clarified that a holiday may be declared only for the shift during which the poll is to be conducted (from 7.00 am to 6.00 pm). Additionally, Government of Maharashtra has notified an exemption for critical services from full-day mandatory closure during general elections.

|

|

|

|

|

|

|

|

|

|