|

|

|

|

in Focus

|

|

|

|

|

|

|

|

|

|

|

|

|

|

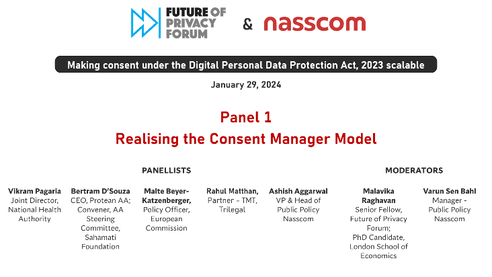

Making Consent Scalable under the DPDPA 2023

|

|

At a webinar co-hosted with the Future of

Privacy Forum, we discussed key factors that

will determine the success of the 'Consent

Manager model' proposed under the Digital

Personal Data Protection Act. The experts

highlighted the need to identify clear

use-cases for consent managers and the scope

for synergies with existing sectoral

parallels, like Account Aggregators.

|

|

|

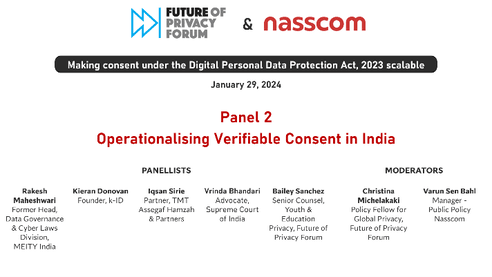

The session on 'operationalising verifiable

consent' focused on the need for a

risk-based approach to verifiable consent

and the scope for consent management

platforms to provide scalable solutions for

data fiduciaries.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interim Budget 2024-25 |

|

The finance minister presented the Interim

Budget 2024 on February 1, 2024. The Interim

Budget of 2024 articulated a vision for a

technology-driven and knowledge-centric

nation by 2047. It lay emphasis on DeepTech,

technology-enabled development to benefit

the last mile, fostering innovation Research

& Development and transformational reforms

to skill, reskill and upskill India's youth.

No changes were proposed in the taxation

regime.

|

|

|

Key highlights:

|

|

|

Proposal to provide a corpus of

INR 1 lakh crores with 50-year

interest free loan to provide

long-term financing/ refinancing

with low/ nil interest rates to

scale up research and

innovation in sunrise domains.

|

|

|

Proposal to introduce a new

scheme for strengthening

deep-tech technologies for

defence

purposes. |

|

|

Sunset date for incorporation to

qualify as eligible startup

under S. 80-IAC of Income Tax

Act, 1961 has been extended by

one year (i.e., till March 31,

2025). |

|

|

Read

More

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBMISSIONS AND REPRESENTATIONS

|

|

|

|

|

|

|

|

|

|

|

MIB

|

|

|

Feedback on the Broadcasting Services

(Regulation) Bill, 2023 |

|

We submitted feedback to MIB on the Draft Broadcasting

Services (Regulation) Bill, 2023.

Our recommendations included: (1) removing

OTT Services from the regulatory framework

of the Broadcasting Bill as they are already

subject to IT Rules, 2021, and (2) Given the

parallel efforts of regulating OTT services

under the DIA, a comprehensive and informed

discussion should happen once the draft of

DIA is published for consultation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Haryana

|

|

|

Feedback on the State of Haryana's proposal

on social security law for mobility workers

|

|

We participated in a consultation meeting

with Deputy CM, Haryana on the proposal for

a state level social security law for

mobility workers. Our feedback highlighted

that: (1) a state-wide survey must be

conducted to plug mobility workers into the

existing state and central government

welfare schemes, and (2) any future state

law, if made, must align with CoSS and cease

to be in effect, once CoSS becomes

operational. |

|

|

|

|

|

|

|

|

|

|

|

|

|

DIALOGUE & DISCUSSION

|

|

|

|

|

|

|

|

|

|

|

Karnataka

|

|

|

Presentation to Karnataka Government on

'Know Your Startup Ecosystem'

|

|

We presented key policies for start-ups and

opportunities to leverage the start-up

ecosystem,

before the officials of Department of

Transport, Government of Karnataka. The

presentation

included overview of initiatives by Central

Government and Government of Karnataka to

support startups and opportunities to

modernise transport infrastructure, managing

resources, enforcing traffic rules etc.

through using solutions offered by tech

startups.

|

|

|

|

|

|

|

|

|

|

|

Export Controls

|

|

|

Participation in the National Conference for

Strategic Trade Controls

|

|

We participated in the first National

Conference on Strategic Trade Controls

organised by DGFT and MEA. We highlighted

the key elements of an effective Internal

Compliance Program, especially for

intangible technology transfers. We also

collaborated with experts from the industry

to highlight best practices in this regard.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEW & UPCOMING

|

|

|

|

|

|

|

|

|

|

|

GST

|

|

|

Request for Inputs: GST

Memorandum |

|

We are identifying key GST

issues that need Government's

intervention. We want to focus

on:

(1) top issues impacting the

industry with considerable

financial ramifications, or (2)

issues that

are being interpreted adversely

and leading to prolonged

litigation. In case you have any

feedback, please send it to tejasvi@nasscom.in

by February 10, 2024.

|

|

|

|

|

|

|

|

|

|

|

Competition

|

|

|

Roundtable on regulating

competition in digital markets

|

|

A joint roundtable on regulating

competition in digital markets

is being organised by nasscom,

IPCIDE and ADBI. The objective

of the roundtable is to discuss

the possible solutions to

effectively address competition

harms in digital markets. We

intend to use the discussion in

this roundtable to develop a

policy brief which may inform

the thinking of policy makers in

designing a regulatory approach

that balances consumer

interests, ease of doing

business and

innovation in India. For more

information, write to policy@nasscom.in.

|

|

|

|

|

|

|

|

|

R&D

|

|

|

Call for Inputs: feedback on new

mechanism to disburse R&D funds

to the industry

|

|

We are seeking industry's

feedback on the best practices

that can be highlighted to the

government as they establish a

new framework for disbursing

funds to the industry for

defence

R&D. If you would like to share

views on the appropriate

IPR-sharing policies in such

public

funded R&D projects and the

appropriate selection criteria

of beneficiaries, kindly write

to policy@nasscom.in.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER UPDATES

|

|

|

|

|

|

|

|

|

|

|

DGFT

|

|

|

Notification on Debonding of Second-hand IT

Assets from SEZ to DTA

|

|

DGFT has now allowed movement of used IT

assets from SEZ To DTA without a license for

further use in their DTA operations given

that there is minimum usage of 2 years in

SEZ and

that the goods are not older than 5 years

from the date of manufacture. This movement

is also subject to the condition that no

exemption from any regulatory requirement

was taken at the

time of import of used asset into the SEZ.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DGFT

|

|

|

Clarification on import licence

for IT Hardware

|

|

DGFT has clarified that only the

following 5 categories of items

under tariff heading 8471

require an import authorisation:

laptops, tablets, all-in-one

personal computers, ultra small

form factor computers and

servers. Other items falling

under this tariff heading (such

as

desktop computers) do not

require an import authorisation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CBDT

|

|

|

Clarification on S.194-O, Income

Tax Act relating to tax

withholding by e-Commerce

Operator

|

|

CBDT has clarified that the

seller-side ECO who finally

makes the payment or deemed

payment

to the seller of goods/ services

shall be liable to deduct tax

under S. 194-O. Further, it has

also

been clarified that where GST/

other state taxes are indicated

separately in the invoice, then

TDS under S. 194-O will apply on

the amount credited without

including such GST or tax

component. These are in line

with nasscom's recommendation

made to Ministry of Finance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MOF, MCA

|

|

|

Indian Public Companies can now

List on International Stock

Exchanges

|

|

Indian public companies (listed

and unlisted) are now allowed to

list on international stock

exchanges, as per the amendments

notified by the government on

January 24, 2024. This is in

line with nasscom's

recommendation to operationalise

the amendments to Companies Act,

2013 which allowed Indian

companies to list on foreign

stock exchanges.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MCA

|

|

|

Policy for public consultation

|

|

MCA has formulated a policy for

pre-legislative consultation and

for comprehensive review of

rules/regulations. This policy

is advisory in nature and aims

towards carrying out public

consultations both at the time

of framing original rules and

regulations, and at the time of

review of the rules/

regulations. This policy shall

be effective from January 1,

2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diversity and Inclusion

|

|

|

'Booklet on DEI considerations for Indian IT employers'

|

|

In collaboration with our

diversity and inclusion team and

knowledge partner Nishith Desai

and

Associates, we published a

booklet summarising the

important legislative provisions

in India

that promote and protect

diversity, equity, and inclusion

at workplaces. The booklet

includes

an overview of

anti-discrimination laws

impacting employers and key

obligations regarding

protected groups.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MOF

|

|

|

"Indian Economy - A review" - Summary of Indian growth trajectory and prospects

|

|

The government released the

'Indian Economy - A Review',

which provides insights into the

Indian economy's trajectory and

prospects over the past decade

and its outlook. The Report

does not replace the official

Economic Survey. The official

Economic Survey is expected to

be

presented after the general

elections and formation of the

new government. Some of the key

highlights of the Report include

a) India is projected to grow to

a $5 trillion economy in the

next

3 years and a potential to reach

$7 trillion by 2030; b) India

has moved from 10th largest

economy of the world to the 5th

largest economy of the world;

amongst others

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List of Acronyms

|

|

|

ADBI

|

Asian Development Bank Institute

|

|

CBDT

|

Central Board of Direct Taxes

|

|

CoSS

|

Director General of Foreign Trade

|

|

DEI

|

Diversity Equity Inclusion

|

|

DGFT

|

Director General of Foreign Trade

|

|

DIA

|

Digital India Act

|

|

DPDPA

|

Digital Personal Data Protection Act

|

|

DTA

|

Domestic Tariff Area

|

|

GST

|

Goods and Services Tax

|

|

IPCIDE

|

ICRIER-Prosus Centre for Internet and Digital

Economy

|

|

|

|

IPR

|

Intellectual Property Rights

|

|

IT

|

Information Technology

|

|

IT Rules

|

The Information Technology (Intermediary Guidelines

and

Digital Media Ethics Code) Rules, 2021

|

|

MCA

|

Ministry of Corporate Affairs

|

|

MEITY

|

Ministry of Electronics and Information Technology

|

|

MIB

|

Ministry of Information and Broadcasting

|

|

MOF

|

Ministry of Finance

|

|

R&D

|

Research and Development

|

|

SEZ

|

Research and Development

|

|

|

|

|

|

|

|

|

|

|

Copyright © 2024, nasscom |

|

|

|

|

|